Financial Modeling & Portfolio Management Excellence

Optimize investment performance across public and private markets with sophisticated modeling tools. Notellect helps investment teams build better financial models, manage complex portfolios, and capitalize on opportunities that others miss.

Why Investment Teams Choose Notellect

Advanced Financial Modeling

Build sophisticated financial models in minutes instead of days. Automate complex calculations and scenario analyses while maintaining complete flexibility and transparency.

Dynamic Portfolio Management

Manage complex portfolios with ease across public and private assets. Optimize allocations, track performance, and rebalance efficiently based on changing market conditions.

Comprehensive Risk Analysis

Identify, quantify, and mitigate portfolio risk with precision. Conduct stress tests, simulate market shocks, and receive early warning alerts for emerging risks.

How Investment Teams Are Using Notellect

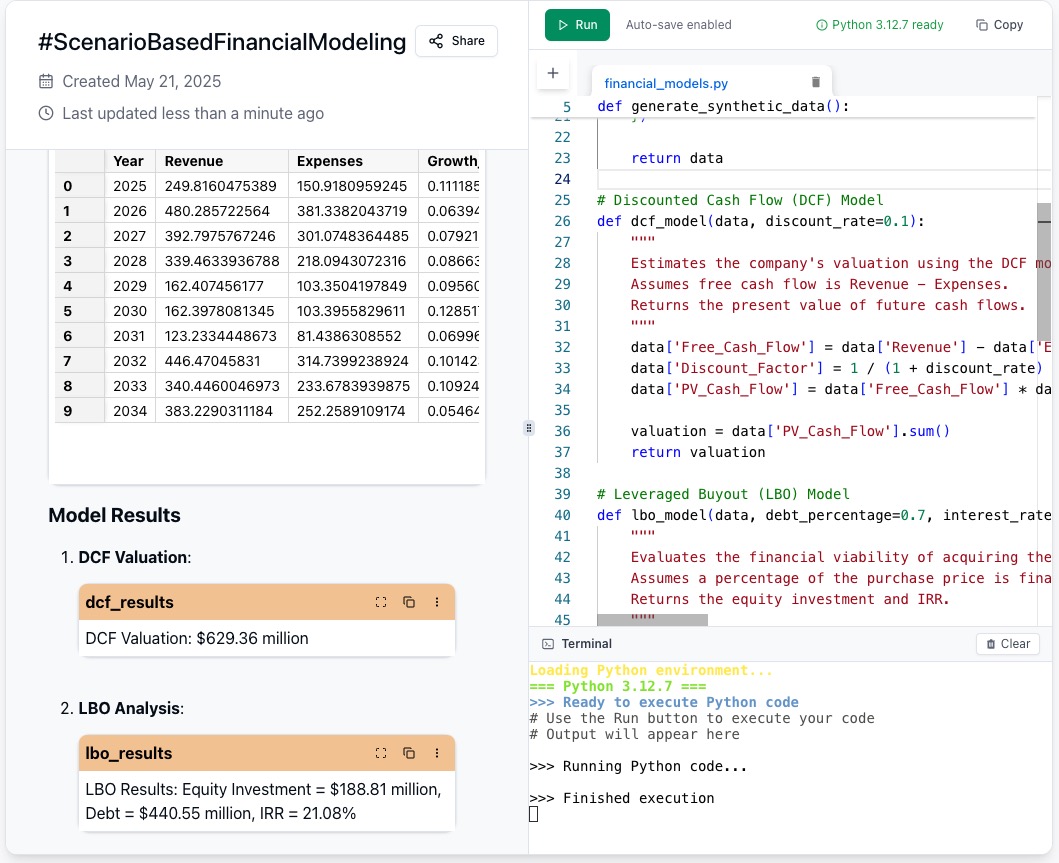

Scenario-Based Financial Modeling

Create dynamic financial models that adapt to changing conditions. Notellect helps you build sophisticated valuation models, cash flow projections, and scenario analyses for both public and private investments.

- Generate sophisticated DCF, LBO, and M&A models in minutes

- Run Monte Carlo simulations with thousands of iterations

- Create dynamic sensitivity analyses across multiple variables

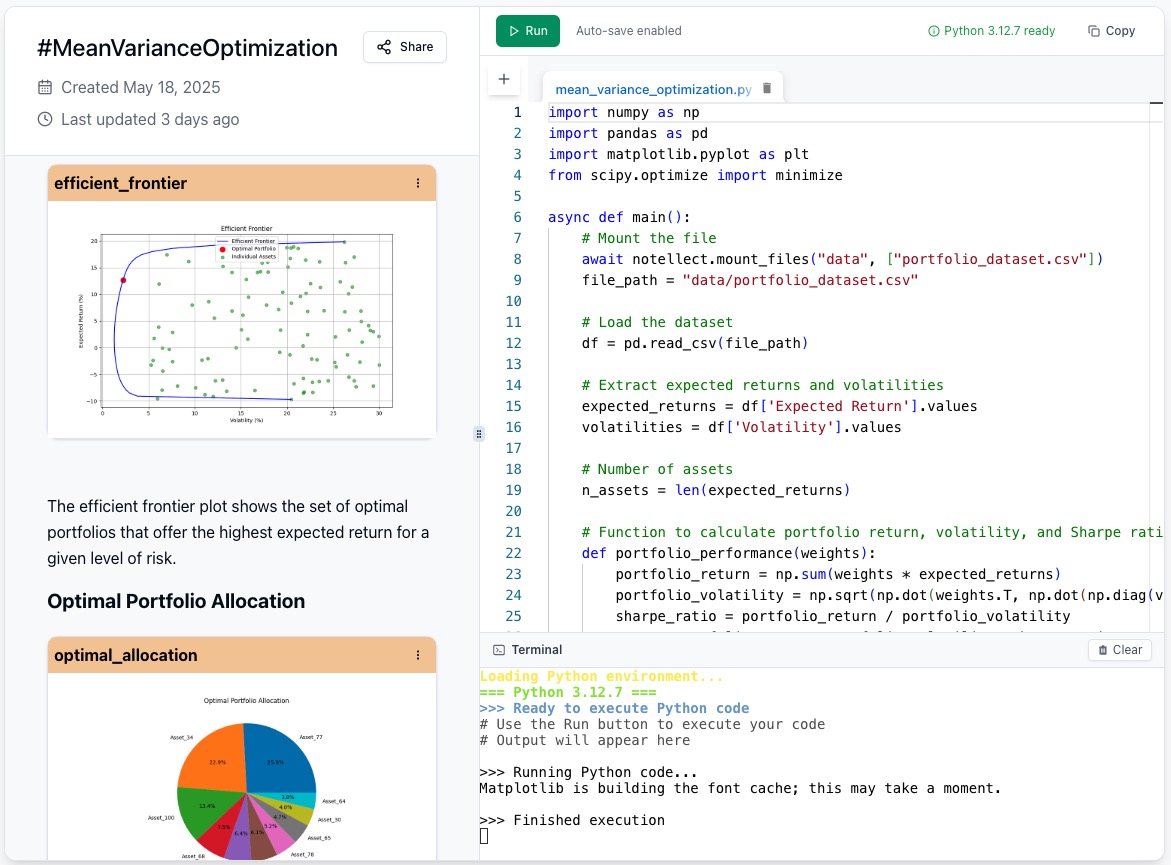

Strategic Portfolio Management

Optimize investment allocations across diverse asset classes. Notellect helps you design efficient portfolios, implement allocation strategies, and track performance against benchmarks and targets.

- Construct optimized portfolios based on your constraints

- Monitor performance across public and private investments

- Automate rebalancing recommendations based on drift thresholds

Ready to transform your financial modeling and portfolio management?

Join investment professionals who are building better models and managing portfolios more effectively with Notellect.